¿Las becas tributan? Guía para maximizar el ahorro

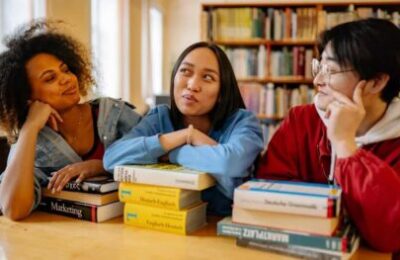

Navigating scholarships and taxes? You’re not alone. Scholarships ease the financial burden of education, but confusing IRS rules can turn “free money” into a tax-time headache. Are scholarships taxable? The answer isn’t always straightforward – it depends on how you use the funds, your enrollment status, and even the fine print of your award. In this guide, […]