How to Convert LLC to S Corp: Tax Savings Unlocked

You launched your LLC with big dreams – flexibility, simplicity, and that sweet pass-through taxation. But now, as profits climb, tax season feels less like a victory lap and more like a slap from Uncle Sam. Agree? You’re not alone.

Here’s the good news: Converting your LLC to an S Corp could slash your self-employment taxes and keep more cash in your pocket. Promise made.

In this guide, we’ll unpack exactly how to convert LLC to S Corp – no MBA required. You’ll learn why savvy business owners use this tax loophole (legally!), how to dodge IRS red flags, and when the switch could backfire. Preview delivered.

By the end, you’ll know:

- If S Corp status fits your growth goals

- The 75-day IRS deadline you can’t afford to miss

- How to sidestep costly compliance mistakes

Ready to transform your tax strategy? Let’s dive in.

Why convert LLC to S Corp?

Imagine handing Uncle Sam a smaller check each year – legally. That’s the headline perk, but the real magic lies in the strategic edge. Let’s break it down.

Convert LLC to S Corp, and you’ll unlock:

Tax savings that feel like a raise

Pay yourself a reasonable salary (subject to payroll taxes) and take the rest as distributions tax-free. For example: A $150K profit could save you $10K annually in self-employment taxes. IRS guidelines confirm this isn’t a loophole – it’s smart structuring.

- Investor magnetism

Corporations speak Wall Street’s language. Convert LLC to S Corp, and suddenly you’re courting venture capital, issuing stock, and building credibility with lenders. - Business immortality

Unlike LLCs, S Corps don’t dissolve if an owner exits. Your empire outlives you – no legal hiccups. - Employee perks that rival Silicon Valley

Offer stock options to your team. Talent sticks around when they own a slice of the pie.

But here’s the kicker: This isn’t just for Fortune 500 wannabes. If your LLC clears $60K+ in annual profits, converting LLC to S Corp could be your golden ticket.

Is S Corp Status right for you? Key considerations mefore converting

Think of an S Corp like an exclusive club—it has rules, and not everyone gets in. Before you rush to convert LLC to S Corp, ask: Does your business fit the dress code?

Here’s the fine print:

- The “100 shareholder max” rule

S Corps cap ownership at 100 shareholders—all must be U.S. residents or citizens. No big investors? No problem. Planning to go global? Red flag. - One class of stock to rule them all

Unlike C Corps, you can’t offer preferred shares or fancy equity tiers. If your growth plan relies on venture capital, this could be a dealbreaker. - IRS salary police

Pay yourself too little? The IRS will reclassify your dividends as salary—and bill you for back taxes. Too much? You’re overpaying payroll taxes. “Reasonable compensation” is a tightrope. - Paperwork olympics

Say goodbye to LLC simplicity. S Corps require annual meetings, meticulous minutes, and bylaws tighter than a drum.

Still want to convert LLC to S Corp? Do this first:

- Crunch the numbers with a tax pro (spoiler: profits under $60K rarely justify the hassle).

- Audit your shareholder roster – no room for international partners or corporate entities.

- Ask: “Can I live with less flexibility?”

How to convert LLC to S Corp: Your step-by-step roadmap

Ready to convert LLC to S Corp? Grab your checklist – this isn’t a DIY project for the faint of heart.

The process is like building a house: Skip a permit, and the whole structure crumbles. Here’s your blueprint.

Step 1: Lay the foundation

- Become a C Corp First

You can’t leapfrog from LLC to S Corp. File articles of conversion (or incorporation) with your state to become a C Corp. Fees vary – think 50to50to500. - Check State Rules

Not all states allow direct conversions. Florida? Easy. California? Prepare for red tape.

Step 2: File IRS form 2553 (The golden ticket)

- Deadline alert: Submit within 75 days of forming your C Corp—or by March 15 for existing entities.

- Shareholder sign-off: Every owner must ink this form. Miss a signature? Denied.

Step 3: Build your corporate machine

- Draft Bylaws: Outline roles, stock rules, and meeting schedules.

- Issue stock certificates: Even if you’re the sole owner.

- Hold your first board meeting: Document everything – minutes matter to the IRS.

Step 4: Never stop complying

- Annual filings: Most states require reports (and fees).

- Payroll setup: Hire a payroll service. S Corps demand W-2 salaries, not 1099s.

Pro tip: Time your LLC to S Corp conversion early in the tax year. File form 2553 late, and the IRS makes you wait another year for benefits.Still overwhelmed? H&S Accounting & Tax Services handles filings, compliance, and IRS chatter – so you don’t have to.

State-specific challenges: Navigating the conversion maze

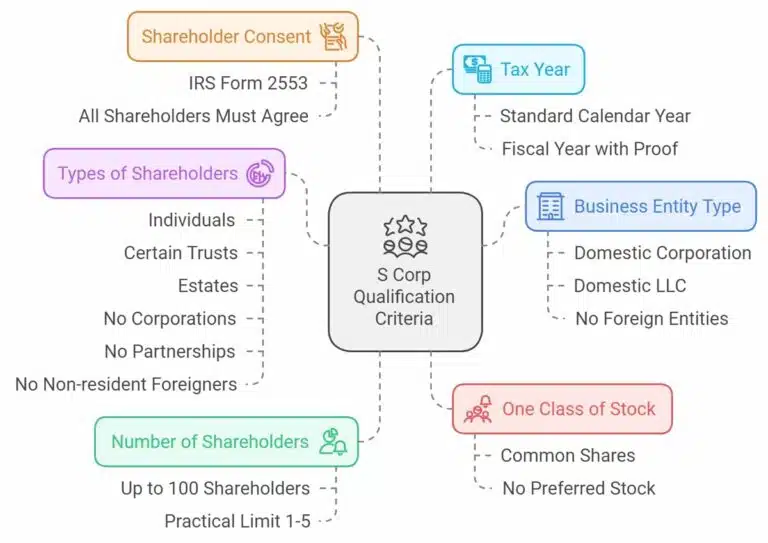

Business entity type – As an initial test, your business must be a domestic corporation, organized within the USA or one of its territori

Trying to convert LLC to S Corp? Your state might be the ultimate gatekeeper.

Picture this: You’ve filed Form 2553, celebrated your tax savings – then get a rejection letter because Alabama requires a merger, not a conversion. Oops.

Here’s the breakdown:

- The “Easy” States

Florida, Texas, and 33 others let you convert LLC to S Corp via a simple certificate of conversion. Fast. Cheap. Done. - The “Merge or Die” Crew

New York, Virginia, and others demand a statutory merger: Create a new S Corp, merge your LLC into it, and file endless paperwork. Budget 4-8 weeks. - The “Start Over” Squad

Pennsylvania and Massachusetts force you to dissolve your LLC entirely before forming an S Corp. Say hello to new fees and goodbye to your original business history.

Pro tip: Check your state’s Secretary of State website before filing. Or let H&S Accounting handle the legwork – because life’s too short for bureaucratic sudoku.

Number of shareholders – On paper, S corps do allow up to 100 shareholders. But tax gurus largely consider them only practical for one-to-five shareholders max. Things get unwieldy fast with too many cooks in the kitchen.

Types of shareholders – If you want to be an S corp, only individuals, certain trusts, and estates can own shares. Other corporations, partnerships, and non-resident foreigners cannot.

Timing is everything: When to convert LLC to S Corp without regrets

Think of converting your LLC to S Corp like planting a garden – miss the window, and you’ll wait a year for harvest.

The IRS’s 75-day deadline is non-negotiable: File Form 2553 within 75 days of forming your C Corp (or by March 15 for existing entities). Skip it, and your S Corp tax benefits get delayed an entire year.

When should you convert LLC to S Corp?

- Profit Milestones: Aim for $60K+ net income – the sweet spot where tax savings eclipse compliance costs.

- Growth Phases: Before scaling your team or courting investors. S Corp status streamlines payroll and impresses stakeholders.

- Calendar Timing: Q1 conversions align with tax year planning, minimizing headaches.

Red Flag: Convert too late in the year, and the IRS may push your election to January 1 – leaving money on the table.

Need to beat the clock? H&S Accounting & Tax Services specializes in deadline-driven filings. Don’t let paperwork delay your payday.

Avoiding IRS landmines: Common conversion mistakes to watch

Converting your LLC to S Corp without a map? The IRS has traps waiting. One misstep could trigger audits, penalties, or worse – losing your S Corp status entirely. Let’s defuse the risks.

Mistake #1: Salary sabotage

Pay yourself $30K while taking $200K in dividends? The IRS will pounce. Set a “reasonable salary” (check IRS benchmarks) or risk reclassified income.

Mistake #2: Paperwork amnesia

Skipping annual meetings or forgetting minutes? The IRS views sloppy recordkeeping as a red flag. Document everything, even if you’re a solo act.

Mistake #3: Deadline roulette

File Form 2553 late, and your tax savings vanish for a year. Mark the 75-day cutoff in bold.

Mistake #4: Documentation black holes

No updated bylaws or stock certificates? Your S Corp election could implode during an audit.

Pro Tip: Partner with a pro like H&S Accounting & Tax Services to navigate the minefield. Before you convert LLC to S Corp, ask: Am I ready to play by the IRS’s rules?

You didn’t build a business to overpay taxes.

Converting your LLC to S Corp isn’t just paperwork – it’s a wealth-building chess move. You’ve now got the playbook: dodge self-employment taxes, attract investors, and lock in perpetual growth.

Remember:

- Timing is ruthless (75 days or bust).

- Compliance isn’t optional (IRS scrutiny is real).

- State rules can make or break your plans.

Why gamble with guesswork? Partner withH&S Accounting & Tax Services to convert LLC to S Corp seamlessly. Their experts handle filings, salary structuring, and state quirks – so you keep thriving, not surviving. Your next tax return could be your smartest yet. Ready to claim what’s yours?