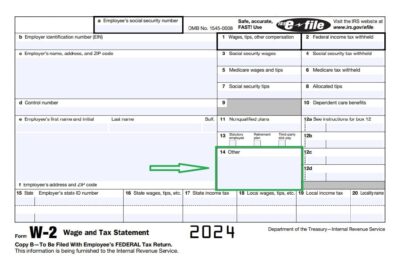

IRS Direct File: All you need to know about this free service

The thought of doing taxes often triggers headaches for Americans. But what if filing could be free and easy directly through the IRS? Enter IRS direct file—the tax agency’s new permanent program launching in 2025 that allows taxpayers to seamlessly submit simple federal returns online without third-party software or tax preparers. Intriguing, right? In this […]